Let’s take a look at MW’s scenario:

“Looking at the actual practise of creating new money, let’s say to finance an infrastructure project such as a railway, there are elements of the PPP (Public Private Partnership). The Government issues bonds. The banks buy the bonds. Meanwhile, the RBA stands in the market ready to buy the bonds from the banks. When the RBA buys the bonds, new money is created.“

The bank’s purchase of the bonds also creates new money not just the central bank’s purchase of the bonds from the banks. Both have the ability to create money ex nihilo. The commercial banks do it when extending loans, the central banks do it when they loan to the commercial banks or through their purchases of government bonds or other securities from the market.

“It could issue $5 billion worth of bonds. The banks and other investors would buy them. Then the Reserve Bank would create $5 billion in new currency by crediting their accounts when it buys the bonds from the banks.“

Correct.

“The upshot? The Government has raised $5 billion worth of funds from the banks for its infrastructure project and the RBA has created another $5 billion which the banks can now lend to the private sector, perhaps to finance their contribution to the railway PPP.“

So what has happened is that $10 billion of new money has been created out of thin air, the true definition of inflation. The real pool of funding has not changed, however the amount of claims to the real pool of funding has increased. This will have the effect of increasing prices throughout the economy. In this case it appears the new money will find its way into the bids for capital goods. So capital goods costs will rise as a result. The additional credit the banks can extend to the private sector will bring interests rates down, however the decrease in the cost of debt is a reflection of inflation, not a reflection of the time preferences of consumers in the economy. No additional savings has been made to reflect a preference to withhold consumption to facilitate investment. Hence the price signals are false and the capital projects that are initiated will be in error because consumer preference for consumption goods have not changed. This is the cause of the boom and bust cycle as the error occurs economy wide given interest rates are common to all market activities. There is no free lunch.

“And what about the grandchildren and the debt the RBA does not buy? If Josh Frydenberg’s grandchildren inherit the debt (the bonds) and Mathias Cormann’s grandchildren pay tax, then the obligation to pay out the bonds out becomes a “zero sum grandchildren game”. One lot of grandchildren pay and another lot of grandchildren receive.

To complete the circle, if we assume the Reserve Bank has bought some of the bonds and held them to maturity, then Mathias Cormann’s grandchildren will pay their tax and the money will go to the bondholder, this time the Reserve Bank.

It then pays the money back to the Government, this time as a dividend, ergo more money for infrastructure, or maybe to help future grandchildren receiving JobSeeker in 2060.”

What MW isn’t considering here is that both sets of grandchildren will have to pay the debt through the debasement of the currency that has occurred. As the inflation permeates through the economy, prices rise. The debt will still have to be paid from the private sector, the money people already hold and the money that will pay the debt will not be worth what it once was. Had the inflation not occurred, capital would have been much more accurately deployed to reflect consumer preferences instead of political preferences. The economy as a whole suffers from this malinvestment, most of all the people at the bottom because they don’t hold assets that could benefit from the inflation. They hold dollars that are now worth less thanks to the ideas of monetary cranks like MW.

There's one (well, actually many, but I'll just deal with one for now) problem with the above, it is bollocks.

All that you say fits well with conventional economic theory and is, as per usual, internally consistent.

But, it does not reflect reality.

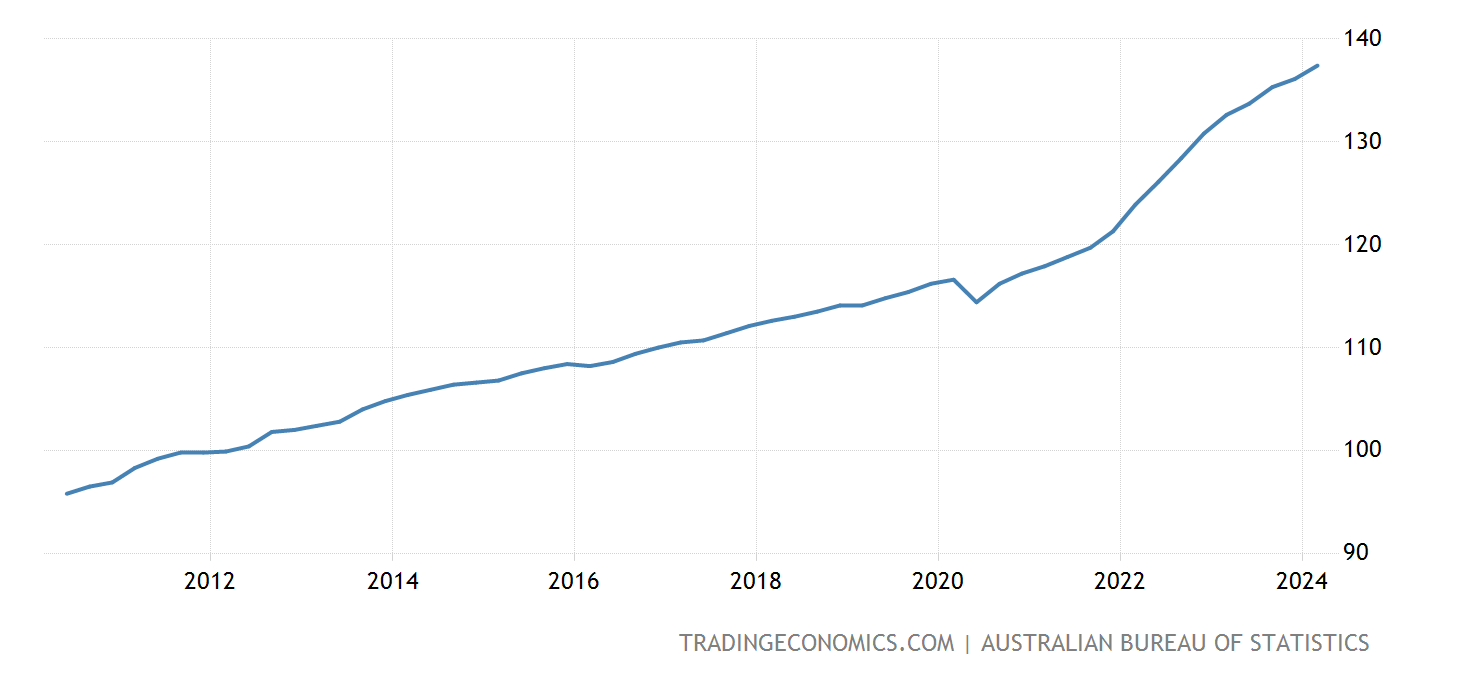

At the time of the GFC governments around the world literally created trillions of dollars out of thin air.

We've had 10 years to see the impact of this now.

Conventional monetary theory as advocated by the clueless neo-liberals would tell you this would lead to massive inflation. All that money chasing the same basket of goods means that the price of those goods must go up, right? Well, right in theory . . . but . . . in the real world it just

did not happen.

Now Gia, I know you think theory is more accurate than reality, but on this point we disagree. Reality trumps theory in my book and the reality is that trillions of dollars were created out of thin air to prop up the banks at the time of the GFC, inflation did not go crazy as Friedman and his clueless neo-liberal comrades predict. In short, the theory failed to work, therefore, the theory is bollocks.

Oh, and where is all the squealing about having to pay that debt back? Oh, that's right, that debt was created in order to prop up the rich so no issue. In any case it will never be paid back and everyone knows it. Furthermore, if the government issues bonds, sells them to banks, and then the reserve bank buys them back, hey presto, the government owes money to, well, to itself, and the profit goes to, hmm, you guessed it, the government. Also, the government can currently borrow at absurdly low rates of interest so any government not borrowing at the moment is insane. The price of money is a bargain, isn't it economically rational to pick up a bargain when you have the chance?

DS